With Kestrel Sustainability Intelligence, we aim to offer market participants access to the industry leader in sustainability and municipal finance. Through Kestrel Analysis and Scores, we provide key insights on value and risk to help market participants make informed decisions and execute faster.

We evaluate bond-financed activities through the lens of environmental and social science, deepened by a practitioner’s understanding of real-world operationally feasible best practices and regulatory frameworks.

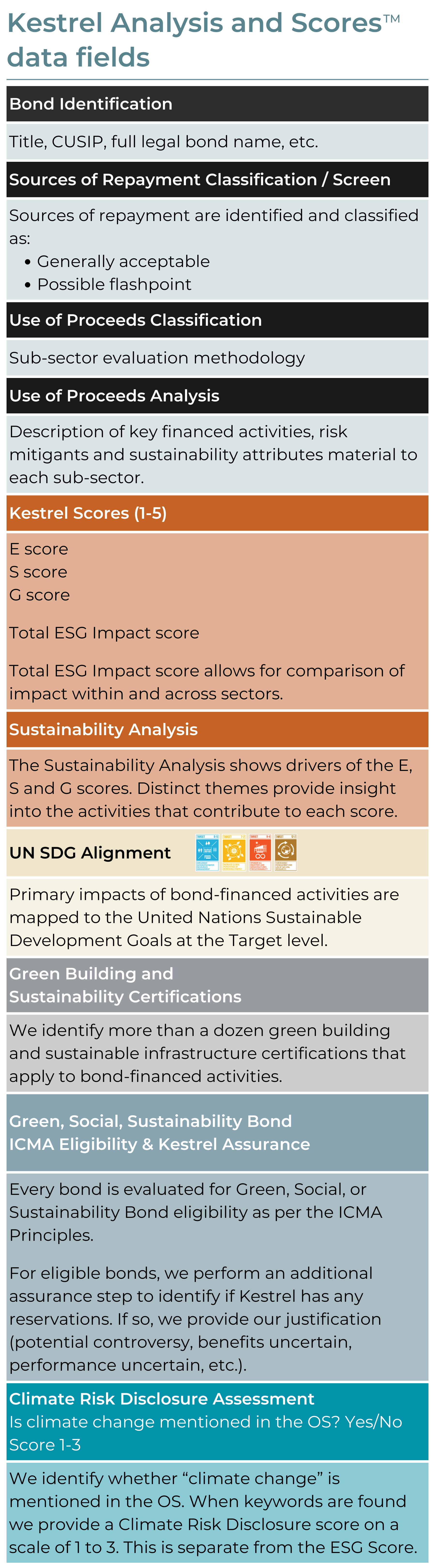

Meaningful ESG data at the CUSIP level, reflecting the impact of bond-financed activities on the planet and society. Kestrel’s ESG Impact Data originates directly from our own smart analysts enabled by technology.

Our methodology is broad enough to encompass other fixed income investments including whole loans, and national and supranational bonds. Call us to collaborate.